The Ultimate Guide to Credit Scores: How They Work & Why They Matter

Your credit score is one of the most important numbers in your financial life. This three-digit number (typically ranging from 300 to 850) predicts how likely you are to repay debt and affects everything from loan approvals to rental applications. Understanding how credit scores work—and how to improve yours—can save you thousands of dollars over time.

1. What Is a Credit Score?

A credit score is a numerical representation of your creditworthiness based on your credit history. Lenders, landlords, and even some employers use it to assess your financial reliability.

The two major credit scoring models are:

- The most widely used model (employed by most lenders)

- A competing model (created by the three major credit bureaus)

While both models consider similar factors, they calculate scores slightly differently.

2. How Credit Scores Are Calculated

Credit scores are determined by five key factors, though their importance varies between models.

Primary Scoring Model Factors:

- Payment History (35%) – The biggest factor. Late or missed payments hurt your score significantly.

- Credit Utilization (30%) – The percentage of available credit you’re using. Keeping this below 30% (ideally under 10%) helps your score.

- Length of Credit History (15%) – Older accounts improve your score. Closing old accounts can hurt it.

- Credit Mix (10%) – Having different types of credit (credit cards, loans, etc.) helps your score.

- New Credit Inquiries (10%) – Applying for multiple new credit lines in a short time can lower your score.

Alternative Scoring Model Factors:

Payment history carries even more weight (40%), while other factors like credit age (21%), utilization (20%), balances (11%), recent behavior (5%), and available credit (3%) make up the rest.

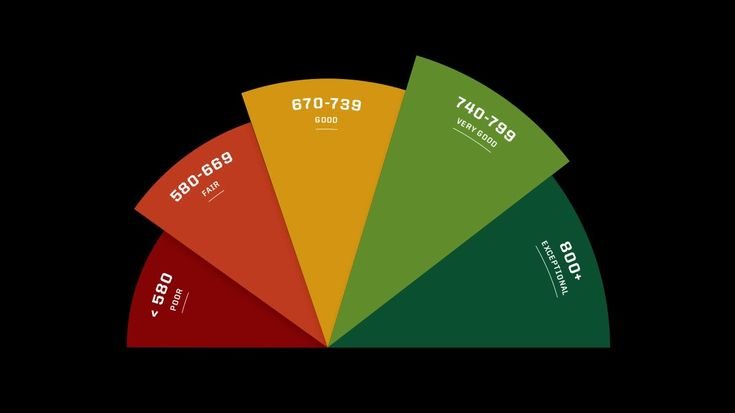

3. Credit Score Ranges and Their Meaning

Credit scores fall into categories that determine your borrowing power:

- 300-579 (Poor) – Difficult to get approved for loans; high interest rates if approved

- 580-669 (Fair) – May qualify for loans but with less favorable terms

- 670-739 (Good) – Eligible for most loans at reasonable rates

- 740-799 (Very Good) – Qualify for low-interest loans and premium financial products

- 800-850 (Exceptional) – Get the best rates and highest approval odds

Note that some lenders have stricter requirements. Certain government-backed loans may accept lower scores, while traditional mortgages typically require mid-600s or higher. Top-tier financial products often demand 720+.

4. Why Your Credit Score Matters

A good credit score unlocks significant financial benefits, while a poor one can cost you thousands:

Benefits of a High Score:

- Lower interest rates (potentially saving $10,000+ on a mortgage)

- Higher credit limits and better rewards

- Easier approval for loans and credit cards

- Better chances when renting apartments or setting up utilities

- Lower insurance premiums in some cases

- More job opportunities (some employers check credit)

Consequences of a Low Score:

- Loan denials or extremely high interest rates

- Required security deposits for utilities and phones

- Higher insurance costs

- Difficulty renting apartments

- Limited access to quality financial products

5. How to Build and Improve Your Credit Score

Quick Improvements (30-90 Days):

- Pay all bills on time (set up autopay to avoid mistakes)

- Reduce credit card balances below 30% of limits (under 10% is ideal)

- Check your credit reports for errors and dispute any inaccuracies

Long-Term Strategies (6+ Months):

- Keep old accounts open to maintain credit history

- Diversify your credit mix with different account types

- Become an authorized user on someone else’s well-managed account

- Consider credit-builder loans if starting from scratch

What Hurts Your Score:

- Late payments (especially those 30+ days overdue)

- Maxing out credit cards

- Closing old accounts

- Applying for multiple new credit lines quickly

- Having accounts sent to collections

6. How to Check Your Credit Score for Free

You can access your credit score through:

- Free credit monitoring services (typically provide scores from two bureaus)

- One of the major credit bureaus (offers a free version of a common score)

- Many banks and financial institutions (provide free scores to customers)

For a complete picture, check your full credit reports annually through the official government-mandated site.

Final Thoughts

Your credit score serves as a financial passport—the higher it is, the more opportunities become available. By understanding how scores work and taking proactive steps to improve yours, you can:

- Save substantial money on loans and insurance

- Gain access to better financial products

- Reduce stress when making major financial moves

Take action today by checking your score and creating a plan to build or maintain strong credit. Small, consistent efforts now can lead to significant financial benefits down the road.

How Credit Cards Impact Your Credit Score

Credit cards play a major role in shaping your credit score—both positively and negatively. How you use them affects payment history, credit utilization, credit age, and credit mix, all of which influence your score.

1. How Credit Cards Help Your Credit Score

✅ Builds Payment History (35% of FICO Score)

- On-time payments boost your score.

- Even one late payment (30+ days late) can hurt your score for years.

- Tip: Set up autopay for at least the minimum payment.

✅ Lowers Credit Utilization (30% of FICO Score)

- Ideal usage: Below 30% of your limit (under 10% for best results).

- Example: If your limit is *$10,000, keep balances under *$3,000 (or $1,000 for optimal scoring).

- Tip: Pay down balances before the statement closes to report lower utilization.

✅ Extends Credit History (15% of FICO Score)

- Older cards increase your average account age, helping your score.

- Closing old cards shortens credit history and can lower your score.

- Tip: Keep your oldest card open (even if you rarely use it).

✅ Improves Credit Mix (10% of FICO Score)

- Having different types of credit (credit cards + loans) helps your score.

- Tip: If you only have loans, adding a credit card can improve your mix.

2. How Credit Cards Can Hurt Your Credit Score

❌ High Credit Utilization (Over 30%)

- Maxing out cards hurts your score, even if you pay in full later.

- Solution: Pay early or request a credit limit increase (without spending more).

❌ Late or Missed Payments

- A single 30-day late payment can drop your score 100+ points.

- Solution: Set up payment reminders or autopay.

❌ Applying for Too Many Cards at Once

- Each application triggers a *hard inquiry, which can lower your score *5-10 points per check.

- Multiple inquiries in a short time signal higher risk to lenders.

- Solution: Space out applications by 6+ months.

❌ Closing Old Credit Cards

- Reduces your available credit, increasing utilization.

- Shortens your credit history if it was your oldest account.

- Solution: Keep unused cards open (use them occasionally to avoid closure).

3. Special Cases: Authorized Users & Secured Cards

Authorized User Benefits

- Being added to someone else’s well-managed card can help build credit.

- Their payment history and credit limit may appear on your report.

- Warning: If the primary user *misses payments, it hurts *both of you.

Secured Credit Cards

- Requires a cash deposit (usually equal to your credit limit).

- Reports to credit bureaus like a normal card, helping build credit.

- Best for: Those with no credit or bad credit.

Final Takeaway

Credit cards are powerful tools for building credit—if used responsibly. By:

- Paying on time

- Keeping balances low

- Maintaining old accounts

- Applying strategically

…you can boost your score and unlock better financial opportunities.