The HDFC bank Freedom credit card is a perfect combination of rewards affordability, making it one of the best entry level credit card in India. Whether you’re a salaried professional, self-employed, or a new credit card user, this reward type card offers 10× reward points on dining, movies, and online shopping, plus fee waivers for high spenders.

In this blog we’ll explore all the benefits, rewards and key features of the card and its charges to help you understand whether it fits your financial lifestyle.

Apply now: https://wee.bnking.in/c/YTFiMTc1O

Key Features:-

- 10X CashPoints on your favourite merchants – Big Basket, BookMyshow, OYO, Swiggy & Uber ( Maximum of 2,500 CashPoints can be earned in a calendar month )

- 1 CashPoint per ₹150 spent on other spends ( Excluding EMI, fuel, wallet loads/prepaid card loads & voucher purchases )

- Get 10% additional discount on Swiggy Dineout using coupon code HDFCCARDS.

- Zero lost Card liability : In the unfortunate event of losing your HDFC Bank Freedom Credit Card, report it immediately to our 24-hour call centre (Toll free numbers 1800 1600/1800 2600. Customers traveling overseas can reach us at 022-61606160). On reporting the loss immediately, you have zero liability on any fraudulent transactions made on your Credit Card.

- Interest Free Credit Period : Avail up to 50 days of interest free period on your HDFC Bank Freedom Credit Card from the date of purchase (subject to the submission of the charge by the Merchant).

- Revolving Credit : Enjoy Revolving Credit on your HDFC Bank Freedom credit card at nominal interest rate. Please refer to the Fees and Charges section for more details.

- Exclusive Dining Privileges : Enjoy amazing dining benefits with Good Food Trail program.

- Get up to 20 % savings off on all your restaurant bill payments via Swiggy Dineout (20k + restaurants) (Offer inclusive of Restaurant and Swiggy Discount). Offer valid only on payments done via Swiggy App

- Fuel Surcharge Waiver: 1% Fuel Surcharge waiver on fuel transactions (Minimum transaction of ₹400, Maximum transaction of ₹5,000 & Maximum waiver of ₹250 per statement cycle)

- Welcome/Renewal Benefit: 500 CashPoints (applicable only on payment of membership fee)

- Renewal Offer: Get renewal membership fee waived off by spending ₹50,000 and above in an annual year

- Smart EMI: HDFC Bank Freedom Credit Card comes with an option to convert your big spends into EMI after purchase.

- Contactless Payment: The HDFC Bank Freedom Credit Card is enabled for contactless payments, facilitating fast, convenient and secure payments at retail outlets. To see if your Card is contactless, look for the contactless network symbol on your Card.

Please note that in India, payment through contactless mode is allowed for a maximum of ₹5000 for a single transaction where you are not asked to input your Credit Card PIN. However, if the amount is higher than or equal to ₹5000, the Card holder has to enter the Credit Card PIN for security reasons.

Apply now: https://wee.bnking.in/c/YTFiMTc1O

Apply now: https://wee.bnking.in/c/YTFiMTc1O

Reward Points/Cashback Redemption & Validity of HDFC Bank Freedom Credit card

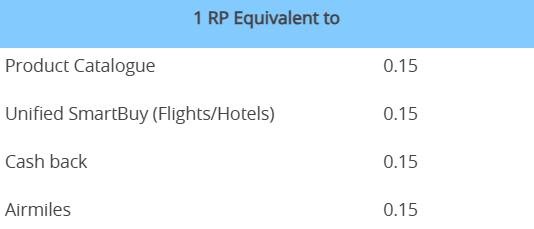

- The CashPoints earned on HDFC Bank Freedom Credit Card can be redeemed against the statement balance at the rate of 1 CashPoint = ₹0.15, and can be done via Net Banking login, or physical redemption form

- CashPoints can also be used for redemption against travel benefits like Flight & Hotel bookings and also on Rewards Catalogue at the SmartBuy Rewards Portal, wherein Credit Card members can redeem up to a maximum of 50% of the booking value through CashPoints at a value of 1 CashPoint = ₹0.15 and the rest of the amount will have to be paid via the Credit Card. To know more on Rewards catalouge,

- With effect from 1st January 2023, Reward points redemption for flights & hotels bookings are capped per calendar month at 50,000.

- With effect from 1st February 2023, Reward points redemption for CashBack redemption are capped per calendar month to 50,000 rewards points.

- With effect from 1st February 2023, cardmembers can redeem upto 70% of product/Voucher value through Reward points on select vouchers/products and pay the remaining amount via Credit card.

- For redemption against cashback, Cardholder must have minimum CashPoints equivalent to ₹500

- CashPoints earned on your HDFC Bank Freedom credit card are valid only for 2 years from the date of transaction. e.g. if you receive Reward Points in August 2021, same will expire in August 2023

Fees and Charges:-

Joining Fees – Rs. 500 + Applicable taxes

Annual Renewal Fee – Rs. 500 + Applicable taxes

Spend ₹50,000 or more in a year, before your Credit Card renewal date and get your renewal fee waived off

Eligibility Criteria:-

| Age: | Job Type: | Net Monthly Income: |

| 21-60 years | Salaried | Rs 12,000+ |

| 21-65 years | Self employed | ITR> Rs 6,00,000 per anum |

In conclusion, the HDFC Bank Freedom Credit Card is an excellent option for beginners and moderate spenders who want to earn rewards on everyday purchases. Whether you shop online, dine out, or book travel, this card ensures you earn while you spend. If you’re looking for an affordable rewards credit card to start your credit journey, the HDFC Freedom Credit Card is a strong contender in 2025.

Apply now: https://wee.bnking.in/c/YTFiMTc1O

Apply now: https://wee.bnking.in/c/YTFiMTc1O

#creditcard #smartmoney #hdfcbank #hdfcbankcreditcard #besthdfcbankcreditcard #freedomcreditcard #hdfcbankfreedomcreditcard

Related blogs:

1)“HDFC Bank Swiggy Credit Card-Ultimate Review, Complete Guide-2025.”: HDFC Bank Swiggy Credit Card-Ultimate Review, Complete Guide-2025. – Merchant Blogger

2)”The Complete Guide to HDFC UPI RuPay Credit Card 2025.”:The Complete Guide to HDFC UPI RuPay Credit Card 2025. – Merchant Blogger

3)” The Ultimate HDFC Bank Pixel series-Benefits, Key Features, Complete Guide-2025”: The Ultimate HDFC Bank Pixel series-Benefits, Key Features, Complete Guide-2025 – Merchant Blogger