If you’re looking for a credit card that supports UPI payments, the HDFC bank UPI Rupay credit card is the best in the list. The HDFC bank UPI Rupay credit card is revolutionizing the way India pays. By merging UPI payments with credit card benefits, it offers a smooth, secure, and rewarding payment experience. With this smart UPI-linked credit card, you can make instant payment, earn cashback, enjoy exclusive RuPay offers-all in one go.

In this blog we’ll explore the key benefits, features, eligibility criteria and who is suitable for the card, so that you can decide if it’s the right choice for your lifestyle and financial goals.

Table of Contents:-

| A to Z Benefits of HDFC bank RuPay credit card |

| How to Maximize the Use of the HDFc bank UPI RUPay credit Card |

| Eligibility criteria |

| Limitations |

| Pros & cons |

A to Z Benefits of HDFC bank RuPay credit card:-

A – Acceptance Everywhere

- Use your HDFC UPI RuPay Credit Card for payments at millions of online and offline merchants across India that accept UPI or RuPay.

B – Bill Payments Made Easy

- Pay utility bills, recharge your mobile, and settle other expenses seamlessly through UPI-linked apps like Google Pay, PhonePe, or Paytm.

C – Cashback Rewards

- Earn cashback or reward points on every UPI transaction and eligible card spends, helping you save more on daily purchases.

D – Digital Payment Convenience

- Make contactless and paperless payments directly through your smartphone using UPI apps-no need to carry the physical card.

E – Enhanced Security

- Enjoy multi-layer security with RBI-approved authentication, PIN-based verification, and instant payment alerts to safeguard your transactions.

F – Free UPI Linking

- Link your HDFC RuPay Credit Card with any UPI app for free and start transacting instantly-no extra setup cost or annual linking fee.

G – Government-Backed RuPay Network

- Benefit from RuPay’s growing domestic acceptance and secure, Indian-developed payment infrastructure.

H – Hassle-Free Rewards Redemption

- Redeem your earned reward points easily via the HDFC SmartBuy or NetBanking portal for gift vouchers, travel bookings, and more.

I – Instant Transaction Updates

- Receive real-time notifications for every UPI transaction made with your HDFC UPI RuPay Credit Card, ensuring full transparency.

J – Joining Offers

- Avail welcome rewards or joining bonuses (if available) when you activate and start using your HDFC UPI RuPay Credit Card.

K – Keep Track of Expenses

- Monitor all your UPI and card-based spends through HDFC NetBanking or MobileBanking, helping you manage your budget smartly.

L – Low-Cost Digital Payments

- Since it runs on UPI and RuPay, transaction charges are minimal compared to international networks like Visa or Mastercard.

M – Mobile Payment Friendly

- Pay instantly using your mobile phone-no card swiping or OTP delay-making it ideal for quick and small-value transactions.

N – No Need for Multiple Cards

- Replace multiple debit and credit cards with one multi-utility UPI-enabled credit card for both online and offline spending.

O – Offers and Discounts

- Enjoy RuPay and HDFC Bank partner offers on dining, shopping, travel, and online purchases throughout the year.

P – Pay Later Flexibility

- Enjoy the ‘Buy Now, Pay Later’ advantage of a credit card while still using the UPI interface for your everyday payments.

Q – Quick and Easy Application

- Apply online through the HDFC website or mobile app and get approval within minutes if you meet the eligibility criteria.

R – Reward Points on UPI Transactions

- Earn reward points even on UPI transactions-something traditional credit cards don’t offer yet.

S – Secure UPI Integration

- Your credit card details are never shared during UPI payments, ensuring safe and tokenized transactions.

T – Tracking Made Simple

- Get a consolidated monthly statement showing both UPI and regular credit card spends for better financial management.

U – Unlimited UPI Flexibility

- Use your HDFC Bank UPI RuPay Credit Card with any UPI app of your choice-no platform restrictions.

V – Value for Every Transaction

- Every purchase, small or big, earns you value through cashback, points, or discounts, maximizing your savings.

W – Wide Merchant Acceptance

- From local stores to e-commerce platforms, your card is accepted nationwide via the RuPay and UPI network.

X – Extra Rewards on Partner Platforms

- Get bonus reward points on select partner platforms during festive seasons or special campaigns.

Y – Year-Round Benefits

- Enjoy 24/7 payment convenience and year-round cashback offers on essential spends like groceries, fuel, and dining.

Z – Zero Hassle Banking

- Manage everything—from card activation to payment tracking-through HDFC’s online banking and mobile app, with zero paperwork.

Apply now- https://wee.bnking.in/c/MmY5YWFkN

How to Maximize the Use of the HDFC bank UPI RuPay credit Card

- Link to multiple UPI apps – Use Google Pay, Paytm, and PhonePe to ensure maximum merchant coverage.

- Use for daily payments– Groceries, petrol, food delivery, pharmacy, etc. earn CashPoints efficiently.

- Leverage EasyEMI– Convert larger UPI spends into EMI to manage cash flow.

- Monitor spending milestones– Cross ₹50,000 in a year to waive annual fee.

- Redeem smartly– Redeem CashPoints for statement credit to effectively lower your bill.

- Combine with SmartBuy– Earn extra rewards when used for shopping through HDFC SmartBuy.

Eligibility criteria

| Age: | 21-65 years |

| Income: | ₹25,000/month-₹6,00,000/month |

| Credit Score: | 750+ |

Apply now- https://wee.bnking.in/c/MmY5YWFkN

Who is Suitable for the Card

✅ Ideal Users:

- UPI-heavy users who prefer cashless, cardless transactions.

- Small business owners making frequent merchant payments via UPI.

- College graduates, freelancers, and professionals seeking low-cost entry into credit cards.

- Those looking to build or improve credit scores via regular, small-ticket UPI spends.

❌ Not Ideal For:

- Users who prefer high-end lifestyle or travel benefits (no lounge or travel rewards).

- People who rarely use UPI or prefer wallet-based payments.

- Heavy international spenders (RuPay acceptance abroad is limited).

Limitations

- Limited reward categories: Cashback mostly applies to UPI merchant spends.

- No international usage: RuPay network is primarily domestic.

- No premium perks: Lacks lounge access, insurance, or concierge benefits.

- CashPoint expiry: CashPoints expire after 2 years if not redeemed.

- Capped rewards: Monthly reward cap may apply depending on spend category.

Pros and Cons

Pros

- ✅ Link directly with UPI for seamless payments.

- ✅ Earn CashPoints on almost all UPI merchant transactions.

- ✅ No need to swipe or tap-100% digital.

- ✅ Affordable annual fee (waivable).

- ✅ Safe, PIN-based authentication.

- ✅ Great for new credit card users.

Cons

- ❌ No lounge, travel, or dining perks.

- ❌ Not ideal for high spenders or frequent flyers.

- ❌ Cash withdrawal and late fees similar to regular credit cards.

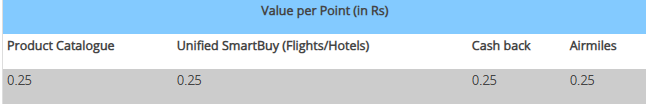

- ❌ Reward redemption value can be lower for some options.

#creditcard #smartmoney #hdfcbankcards #besthdfccards# bestcreditcard #upirupaycard #upirupaycreditcard #hdfcupirupay #hdfcupirupaycreditcard #hdfcbankupirupaycreditcard

Apply now- https://wee.bnking.in/c/MmY5YWFkN

Also Checkout:-

1. “HDFC Bank Millennia Credit Card Review 2025: Benefits, Cashback, Fees & Smart Usage Tips”- HDFC Bank Millennia Credit Card Review 2025: Benefits, Cashback, Fees & Smart Usage Tips – Merchant Blogger

2. “The Ultimate A-to-Z Guide to HDFC Bank MoneyBack+ Credit Card-Exclusive Benefits & Next-Level Savings!”- The Ultimate A-to-Z Guide to HDFC Bank MoneyBack+ Credit Card-Exclusive Benefits & Next-Level Savings! – Merchant Blogger