Fuel costs can be unpredictable, but with the SBI BPCL Credit Card, you can save on every fill-up. This card, a collaboration between SBI and BPCL, helps you earn rewards and waivers on fuel purchases, making it a smart choice for daily commuters and frequent drivers.

Here’s a closer look at the SBI BPCL Credit Card: features, benefits, fees, rewards, pros & cons-all dissected to help you decide if it’s the right fit for your spending habits.

What Exactly Is the SBI BPCL Credit Card?

The SBI BPCL Card launched as an entry-level fuel-focused card, it is a co-branded fuel credit card offered by SBI Card in partnership with Bharat Petroleum (BPCL). This card is tailored to reward you on BPCL fuel buys, putting cashback in your pocket.

There are two main variants:

- Standard BPCL SBI Card [Apply now- https://wee.bnking.in/c/ZDRhZjkzM]

- BPCL SBI Octane – A step-up version with boosted rewards and extra benefits.

Key Features & Benefits:

Fuel-Related Benefit (Standard Card)

- Value Back: Get 4.25% cashback on BPCL fuel purchases, earned through 13× reward points on every Rs 100 spent.

- Fuel Surcharge Waiver: BPCL transactions get a 1% fuel surcharge waiver, capped at Rs 4,000 per transaction (GST extra).

- Cap on Fuel Surcharge Waiver: You’ll save up to Rs 100 per billing cycle on surcharges, adding up to around Rs 1,200 annually if you max it out.

- Reclamation / Redemption: Cash in your reward points for instant free fuel at 1,200+ BPCL stations or option for BPCL fuel vouchers.

- No Minimum Threshold: To redeem for fuel, there is no minimum number of points required.

- Monthly Fuel Spend Limit: Value-back benefits cap at Rs 10,000 monthly eligible spend.

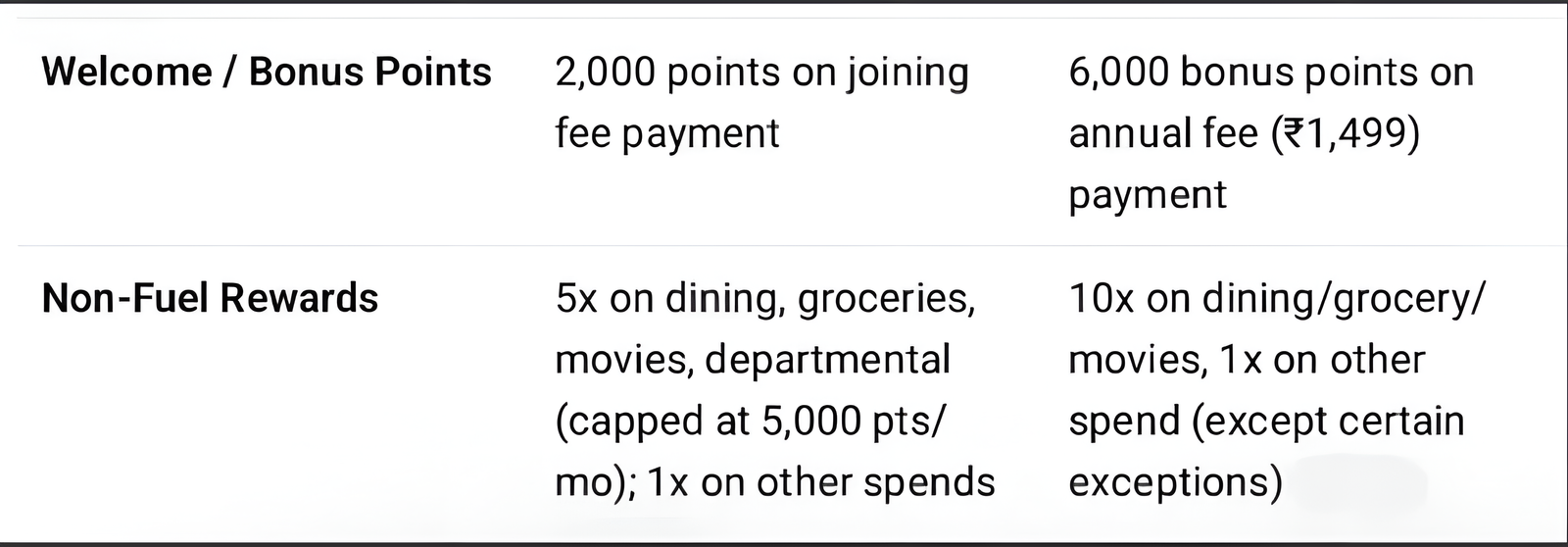

Other Reward Categories:

- Earn 5X reward points (5 points/ Rs 100) on dining, department stores, groceries and movies, up to 5,000 points/month.

- 1 point/Rs 100 on other retail buys (excluding mobile top-ups and non-BPCL fuel).

- Value of reward point: 4 points = Rs 1 fuel redemption value.

Welcome Bonus:

- Joining fee gets you 2,000 bonus points (Rs 500 value).

- Bonus points credited around 20 days post-joining fee payment.

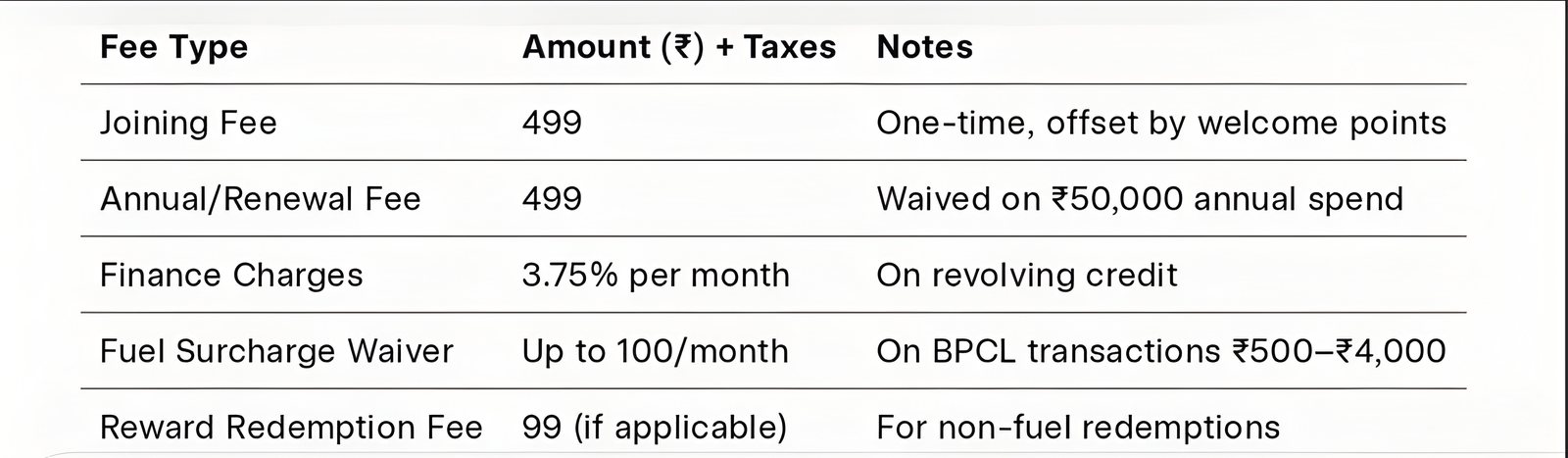

Fees, charges and other features:

- Joining/Annual Fee: Rs 499 as joining (or renewal) fee.

- Fee Waiver: Spend Rs 50,000+ annually to waive the annual fee.

- Balance Transfer: You can shift outstanding balances from other credit cards to this card and convert to EMIs.

- Flexipay: Convert big purchases (Rs 2,500+) to EMIs via SBI Flexipay within 30 days of transaction.

- Contactless Payment: The card supports contactless payment.

- Worldwide Acceptance: Accepted worldwide wherever the card network is accepted.

Advantages and Drawbacks: Things to Watch out:

Advantages:

- High Fuel Savings

- 4.25% fuel rebate on BPCL is a great deal for fuel users.

- Surcharge waiver adds to the perk for loyal BPCL customers.

- Instant Redemption

- You can redeem points on the spot at BPCL, no need to wait or stockpile points

- Low Fee or Waiver

- The annual fee is Rs 499, but you can waive it with just Rs 50K spend.

- Decent Non-Fuel Rewards

- 5X points on daily essentials like dining groceries, movies, and departmental stores is a useful bonus for everyday spending.

- Financial Flexibility

- Flexipay and balance transfer features make it a cash flow management tool, beyond just rewards.

Apply now- https://wee.bnking.in/c/ZDRhZjkzM

Drawbacks:

- Cap on Fuel Benefits

- For power users who spend a lot on fuel, the Rs 100 cap on surcharge waiver might limit the overall benefit.

- Also, the 4.25% cashback is capped at Rs 10,000 monthly fuel spends.

- Reward Point Limitation

- In non-fuel categories, 5x points is great, but capped at 5,000 points monthly.

- The general retail rewards rate is 1 point per Rs 100, which is standard.

- Redemption Constraints

- Redemption is instant, but tied mostly to BPCL, limiting flexibility.

- Surcharge Complexity

- 1% waiver is limited to Rs 4,000 per transaction, so bigger bills aren’t fully covered.

- GST might apply to the surcharge, adding to the cost.

- Some BPCL pumps have issues with merchant ID registration, affecting rewards.

- Annual Fee Risk

- If you miss Rs 50,000 spend, then Rs 499 renewal fee kicks in.

- Value hinges on your BPCL fuel spendand qualifying purchases.

- Alternative Cards

- If you don’t strictly buy fuel from BPCL and it isn’t your go-to fuel station, other cards might suit you better.

- A premium card might offer more value for high spenders.

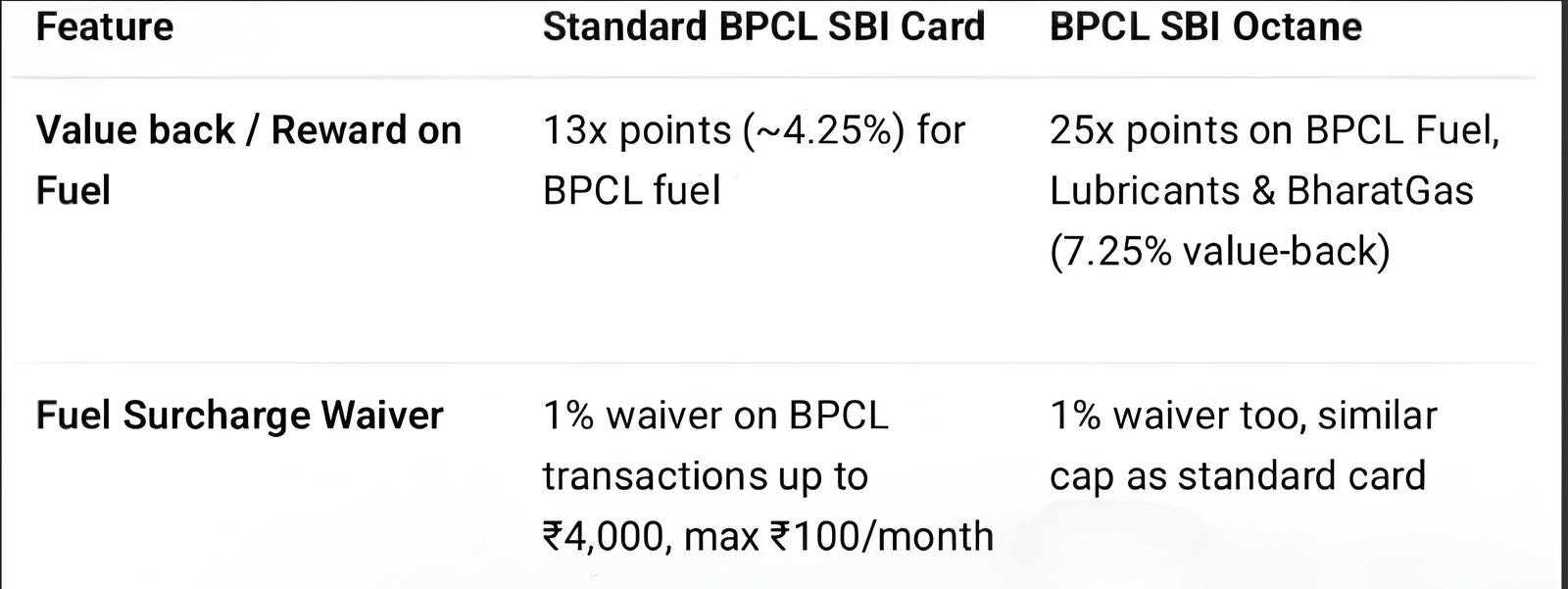

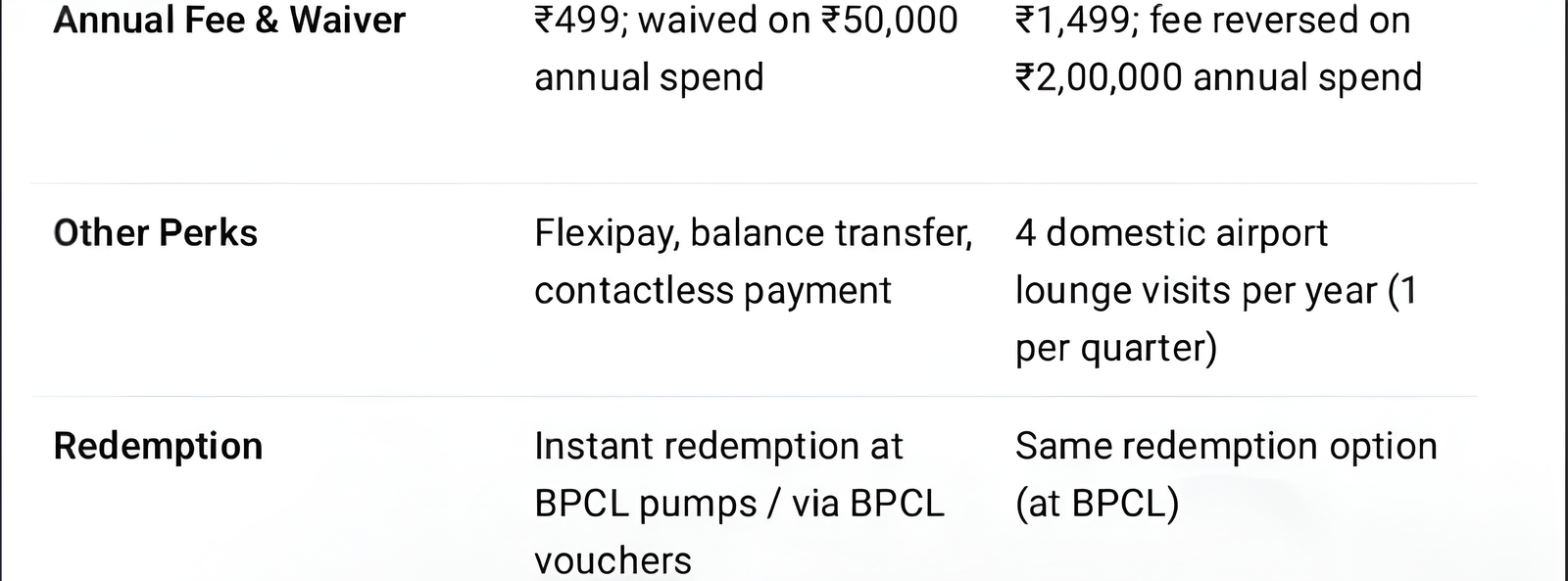

Comparison: Standard BPCL vs BPCL Octane

Table No. 2

Verdict on Comparison:

• Use Standard BPCL SBI Card if: You are searching for a low-fee fuel card, your spend are moderate and you want to maximize fuel savings without paying high annual fee.

• Use BPCL Octane if: You fuel too much with BPCL, experience the higher reward rate, and can meet the high annual spend to waive the annual fee and you also want lounge access or are more “premium” in usage.

Real-User Feedback & Criticism

The card looks great on paper, but user reviews reveal some hiccups.

- POS / Merchant ID Issues:

Some BPCL pumps have POS issues, causing waiver or points to slip through.

- Surcharge Computation Problems:

There are complaints like:

“I did a transaction of Rs 2,000 for fuel… got charged ~2.5%… only Rs 20 was refunded.”

- Annual Fee Reversal Delays:

Some users’ issues with fee reversal, needed to follow up. - Octane Variant Frustrations:

The Octane card’s promised rewards can be tough to get; some users say:

“I usually get around ₹30,000 worth of fuel every month… not every BPCL fuel station accepts credit card & redeems your reward points.”

- Merchant-List Changes:

SBI updates BPCL merchant IDs monthly, so qualifying stations can change.

Who is This Card Best For?

Ideal For:

- Frequent BPCL fuel buyers, like monthly fill-up users.

- Ideal for those who prioritize fuel savings and don’t mind a fuel-specific card.

- Suitable for those who hit Rs 50,000 spend or don’t mind the Rs 499 fee.

- Great for users who want instant fuel rewards redemption.

Less ideal for:

- Users who use other fuel brands (like HPCL or IOCL) frequently – since the main reward is BPCL-focused.

- Rare card users (if you don’t spend a lot on fuel or the other reward categories).

- Not ideal if you’re concerned about waiver or redemption issues.

- Those seeking premium or travel-centric benefits, unless Octane fits.

Final Verdict: Is it worth it?

Yes — if used smartly, the SBI BPCL card is a great pick for fuel enthusiasts, 4–25% value-back and surcharge waiver are awesome, and that Rs 499 fee’s pretty manageable, especially with the spend waiver option.

However, you need to be realistic:

- The waiver and value-back caps at Rs 100 mean benefits plateau after a point.

- Points are pretty rigid, only usable with BPCL or their vouchers, not super flexible.

- Benefit application can be hit or miss, so keep an eye on your statements and know your local BPCL pump’s policies.

If you’re a big BPCL spender, this card’s worth it; otherwise explore other options for flexibility or premium perks.

#sbi #bpcl #creditcard #smartmoney #sbibpcl #sbibpclcreditcard #bpclcreditcard

Apply now- https://wee.bnking.in/c/ZDRhZjkzM

Apply now- https://wee.bnking.in/c/ZDRhZjkzM

Also checkout:

- SBI Cashback Credit Card-Rewards in every swipe-2025: SBI Cashback Credit Card-Rewards in every swipe-2025 – Merchant Blogger

HDFC Bank Swiggy Credit Card-Ultimate Review, Complete Guide-2025.: HDFC Bank Swiggy Credit Card-Ultimate Review, Complete Guide-2025. – Merchant Blogger