Looking for the best cashback credit card for food delivery and online shopping in India? The HDFC Swiggy Credit Card is one of the best cards you’re looking for. With HDFC Bank’s reliability and swiggy’s vast digital ecosystem, this card rewards you with 10% cashback on swiggy orders, 5% cashback on major online sites, and a free Swiggy one membership for 3 months on card activation this card is designed for India’s growing community of digital spenders.

In this blog we’ll explore all the features, A to Z benefit’s, eligibility criteria of the HDFC Bank Swiggy credit card–to help you decide If it’s the ideal choice for your lifestyle.

A to Z benefits of HDFC bank Swiggy Credit card:-

A — Annual fee waiver:

- The card has a renewal (annual) fee of ₹500 + GST, which is waived if you spend ₹2,00,000 or more in the preceding year.

B — Bonus/cashback on Swiggy platform:

- Earn 10% cashback on spends on the Swiggy ecosystem (food delivery, groceries via Instamart, dining out via Dineout, Genie pick-up/drop).

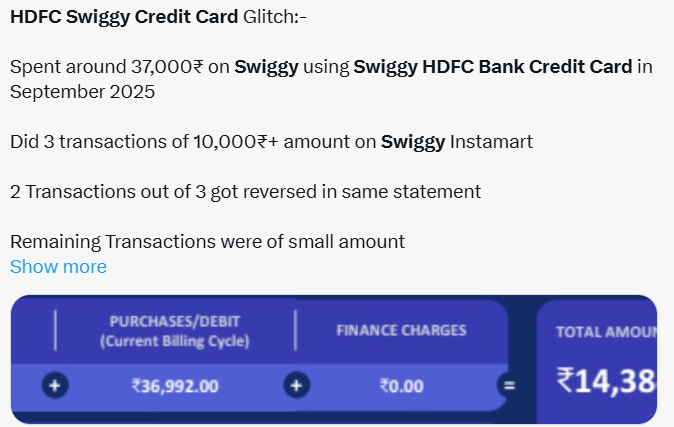

C — Cap on monthly cashback:

- For the Swiggy 10% category, there is a monthly cap–₹1,500 per billing cycle.

D — Digital (online) spends cashback:

- 5% cashback on eligible online spends (select e-commerce/brands) up to a cap (₹1,500 per month).

E — EMI Facility:

- Convert large purchases on your Swiggy HDFC Bank Credit Card into Smart EMI and enjoy stress-free repayments.

- Balance Transfer on EMI – *1% of Loan Amount, Minimum Rs250 (exclusive of GST)

F — Free Swiggy One membership:

- On activation of the card you get 3 free months of the Swiggy One subscription (which offers benefits like free deliveries, discounts in the Swiggy ecosystem).

G — Gadget/large-purchase flexibility through Smart EMI:

- The card supports converting large transactions into EMI (‘Smart EMI’) thereby giving flexibility.

H — High annualised potential savings:

- With full usage (10% on Swiggy + 5% online + 1% other), the bank states you can save up to around ₹42,000 annually. I – Interest-free credit period: Up to 50 days interest-free period from purchase to payment due (subject to merchant and terms).

J — Joining/first-year fee offer or lifetime-free variant:

- At times there are offers where the card is lifetime-free (“LTF”) for new applicants (check eligibility and cut-off dates).

K — Kitted for contactless payments:

- The card supports contactless tap-to-pay for small transactions (India rules apply) for convenience.

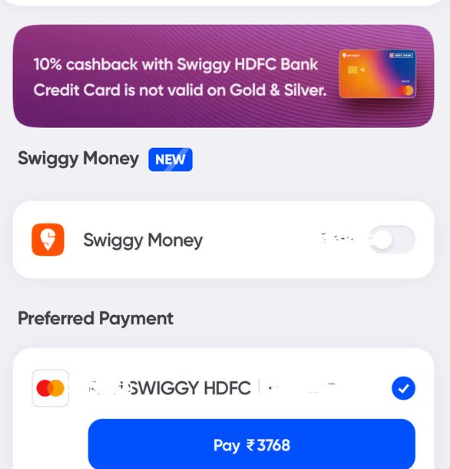

L — Linkage with Swiggy app:

- You must link the credit card to your Swiggy account/app to fully unlock membership and benefits.

M — Monthly caps across categories:

- Not just the Swiggy category but also other categories (like the 5% online and 1% other) have monthly caps (e.g., ₹1,500 for 5% category and ₹500 for 1% category).

N — No liability on lost card (if reported promptly):

- The card offers zero liability for fraudulent transactions if you report loss/theft ASAP.

O — Other spends cashback:

- 1% cashback on “other” eligible spends (offline/other categories) up to ₹500 per month.

P — Programs/co-benefits via Mastercard World Tier:

- The card is on the Mastercard World Tier network and may offer access to some global benefits, promotions in travel/shopping/sport.

Q — Quick commerce/groceries benefit:

- Since Swiggy’s Instamart is covered in the Swiggy spend category (10% cashback), it gives a boost for grocery/quick commerce via that platform.

R— Reward redemption shift to statement credit:

- As of 21 June 2024, cashback earned will be credited as statement credit rather than only as Swiggy Money (depending on T&Cs).

S — Spends required to waive renewal fee exclude some categories:

- To get the fee waiver you must spend ₹2 lakh in a year, but some spends like cash withdrawals, balance transfer, cash-on-call don’t count.

T — Transparency of MCC (Merchant Category Code) matters for 5% category:

- The 5% online category depends on whether the merchant transaction is under the eligible MCC. Some users report inconsistency due to MCC coding.

U — Usage discipline benefits:

- If you are a frequent Swiggy user (food + groceries) and also spend significantly online, you’ll extract the best value. If not, the 10% category may see little benefit. (This is more an insight than printed benefit.)

V — Variety of platforms covered:

- The online 5% benefit spans multiple categories — apparel, electronics, home décor, personal care, cabs, pet supplies etc.

W — Welcome benefit trigger:

- The free membership and benefits are on activation of the card—just receiving the card is not enough. Make sure you activate promptly.

X — Exclusion clarity:

- Some categories do not earn cashback — e.g., fuel, rent, jewellery, wallet loading, government payments. Worth checking these.

Y — Yearly savings can be high but require high spends:

- The quoted “up to ₹42,000” is based on maxing the caps each month (₹1,500 + ₹1,500 + ₹500 = ₹3,500 × 12). Actual savings will depend on your real spend.

Z — Zero immediate lounge access (for now):

- While the card is World Tier, many users report that standard lounge access perks are not included (or are unclear) — so don’t assume premium travel lounge access without verifying.

Apply now- https://wee.bnking.in/c/Y2IwMTk3O

Note:-

- Cashback redemption will move to Statement credit w.e.f 21st June’24, while the existing Swiggy money will continue to be in the Swiggy App

- Cashback cannot be earned on transactions made using Swiggy Money Wallet, Swiggy Minis & Swiggy Liquor, and any other categories decided later (if any)

Eligibility Criteria:-

For Salaried Indian national:

Age: Min 21 years & Max 60 Years

Net Monthly Income > Rs.15,000

For Self Employed Indian national:

Age: Min 21 years & Max 65 Years

ITR > Rs 6 Lakhs per annum

Credit score: 700+

Apply now- https://wee.bnking.in/c/Y2IwMTk3O

Mastercard Golf Benefits:-

- Access to golf courses worldwide and 12 free lessons per year

- 4 complimentary rounds of green fees per calendar year

- Discounted golf services at 50% of the green fee beyond complimentary sessions

Please follow below link in order to view step to redeem the benefits

Link : World Card India Golf Program | Priceless Specials

Limitations:

- Cashback categories come with monthly caps: For example, the 10% on Swiggy-ecosystem transactions and the 5% on online spends are capped each billing cycle.

- Some categories are excluded from cashback: fuel, rent, jewellery, EMIs, wallet loads, government transactions, etc.

- The high benefit categories depend on correct merchant category codes (MCCs) and fulfilment of conditions—some transactions may not qualify.

- Annual fee waiver requires a relatively sizeable spend (₹2 lakh in a year) to avoid the renewal fee.

- Fewer premium perks compared to other credit cards (for example: no airport lounge access, limited offline benefits).

- Some users have reported customer service issues, linking problems, lower credit limits than expected.

Pros:

- High cashback on Swiggy ecosystem: 10% cashback on food delivery, Instamart groceries, Dineout, Genie services under the Swiggy umbrella.

- Good cashback on online spends: 5% on selected online merchant categories, which is attractive for online-shoppers.

- Low base annual fee (₹500 + GST) and the possibility to waive it if you meet the spend threshold.

- Welcome benefit: Complimentary ~3-month Swiggy One membership (free deliveries, discounts) on activation of the card.

- Cashback is credited as statement credit (or usable value) rather than only restricted format—makes it more flexible.

- Good for people whose spend profile matches: frequent Swiggy user + online shopper => can extract good value.

Cons:

- If you don’t use Swiggy frequently (or your online spend is limited in the eligible categories), the rewards may not compensate for the fee or may be under-utilised.

- The caps and exclusions mean high spenders might hit the limits quickly and then earn just minimal benefits beyond that.

- The card is more tilted towards digital / online usage; offline purchases (outside Swiggy/online) only earn 1% cashback, which is lower compared to many other cards.

- For larger travel / lifestyle perks (airport lounges, travel insurance, higher reward tiers), this card may fall short compared to premium offerings.

- High interest rate if you carry a balance — as with most cards, if you don’t pay in full it can negate the reward benefits.

- Some reports of low credit limit or application rejection even for users with good profile; linking the card to Swiggy app may face issues.

Who Should Consider the HDFC Swiggy Credit Card?

The HDFC Swiggy Credit Card is tailored for individuals who frequently engage with the Swiggy ecosystem and online shopping platforms. It’s ideal for:

- Frequent Swiggy Users: Those who regularly order food, groceries, or use services like Dineout.

- Online Shoppers: Individuals who frequently shop on e-commerce platforms such as Amazon, Flipkart, and Myntra.

- Tech-Savvy Consumers: People comfortable with digital payments and managing finances through mobile apps.

- Budget-Conscious Shoppers: Those looking to maximize cashback and rewards on everyday spending.

- Salaried Individuals: With a monthly income exceeding ₹15,000.

- Self-Employed Professionals: With an annual Income Tax Return (ITR) of over ₹6 lakh.

Apply now- https://wee.bnking.in/c/Y2IwMTk3O

Who Might Not Benefit from the HDFC Swiggy Credit Card?

While the HDFC Swiggy Credit Card offers attractive benefits, it may not be suitable for:

- Infrequent Swiggy Users: Individuals who rarely use Swiggy for food delivery or other services.

- Low Online Shoppers: Those who seldom shop online and thus cannot leverage the 5% cashback on online spends.

- Offline Spenders: People who primarily make purchases in physical stores, as the card offers only 1% cashback on offline transactions.

- High-Interest Rate Avoiders: Individuals who may carry a balance and wish to avoid the 3.75% monthly finance charge.

Apply now- https://wee.bnking.in/c/Y2IwMTk3O

In conclusion, the HDFC Swiggy Credit card is one of the best cashback credit card in India if food delivery and online shopping are a part of your daily life. It not only rewards you for every Swiggy order but also gives great cashback on your favorite shopping sites.

With its affordable, rewarding, easy eligibility, annual fee waiver, the HDFC Swiggy Credit Card is a smart financial choice for anyone looking to maximize savings on everyday spending. Apply now- https://wee.bnking.in/c/Y2IwMTk3O

Also Checkout:-

1. “HDFC Bank Millennia Credit Card Review 2025: Benefits, Cashback, Fees & Smart Usage Tips”- HDFC Bank Millennia Credit Card Review 2025: Benefits, Cashback, Fees & Smart Usage Tips – Merchant Blogger

2. “The Ultimate A-to-Z Guide to HDFC Bank MoneyBack+ Credit Card-Exclusive Benefits & Next-Level Savings!”- The Ultimate A-to-Z Guide to HDFC Bank MoneyBack+ Credit Card-Exclusive Benefits & Next-Level Savings! – Merchant Blogger

#creditcard #smartmoney #hdfcbank #hdfcbankcards #besthdfcbankcards #hdfcswiggycreditcard #hdfcbankswiggycreditcard #swiggycreditcard.