Buy now, pay later (BNPL) has quietly entered into our daily lives from ordering food and groceries to buying a new washing machine and phone. It is the option that assures you during checkout that “Go ahead take it home…… you can pay me later” For today’s generation that values speed flexibility and convenience, BNPL feels like a saviour. No bank issues paperwork, no waiting for approvals just instant confirmation when you need it.

Behind this simple idea is a major shift in how shop, borrow and manage money. BNPL has turned traditional credit on its head, giving people the power to buy what they need without the headache of paying for everything upfront its smooth, its modern and when used wisely, it I a genuinely helpful financial option

In this blog we’ll explore what is BNPL, how it works, types of BNPL, benefits, limitation, its rules and who should us it.

What is BNPL?

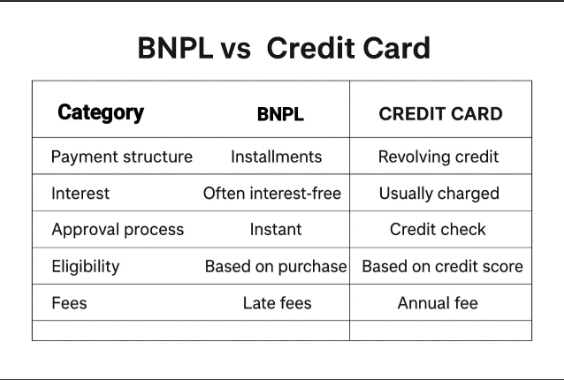

Buy now, pay later (BNPL) is a Modern Point of Sale (POS) and a short term financing method that allows consumers to purchase items immediately and pay for them over the time in installments, often interest free if paid in time (typically over weeks or months). It is a famous alternative to credit cards or personal loans especially in e-commerce; BNPL is usually offered directly at checkout by third-party fintech companies and is designed to be fast and seamless. BNPL has become extremely popular because it gives customers the convenience to shop without paying the full amount upfront.

Why BNPL exists?

Common credit card options (like credit cards or loans) are harder for the new borrowers or youth’s to access because:-

- It requires credit history.

- They have higher rates of interest

- They need paperwork

BNPL becomes the saviour in this situation by giving instant, low friction credit with:

- No paper work

- Instant OTP based approval

- NO interest (If paid timely)

How BNPL works; Step-by-step

1.Shopping and checkout:

- You add items to your cart on an online store or shop in a physical store.

- During checkout, you can see BNPL as a payment option alongside credit/debit cards UPI, etc.

2.Select BNPL provider

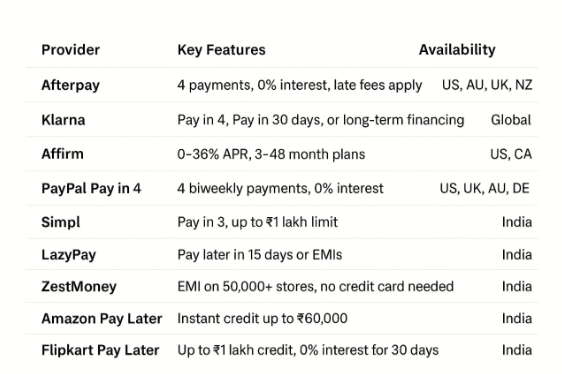

- Common Global Providers: Afterpay, Affirm, paypal,etc.

- India-Specific or widely available: Lazypay, simpl, Amazon paylater, Flipkart Paylater, etc.

3.Instant approval:

- Enter basic details(Name, email, phone, PAN or Aadhaar in India)

- A quick credit check in performed (does not affect credit score)

- Approval happens in seconds.

- Another option, you enter mobile number, then give otp instant limit is given.

4.Payment Structure:

Generally BNPL plans fall into two categories:

| Item | Structure | Interest | Duration |

| Short-term (Interest-free) | 4 equal payments (ex:25% during purchase, 25% every weeks) | 0% if paid on time | 6-8 weeks |

| Long-term (Installment loans) | Monthly EMIs over 3-48 months | 0-36% | 3 months to 4 years |

5.The provider pays the merchant:

The merchant gets the full amount immediately you repay the BNPL Company in parts.

Types of BNPL Models:

1.”Pay later” model:

Buy today-pay full amount next month.

2.”Pay in installments”model:

You can split the payment into 3-6 payments according to your wish.

3.”No cost EMI”model:

Allows you to purchase product and pay for it in fixed, equal monthly installments without incurring any explicit additional interest charges. The total amount the customer pay over time is equal to the product’s original price

4.Card-based BNPL

BNPL companies issue a prepaid or virtual card for BNPL payments.

Benefits of BNPL (For consumers):

- No or low interest(If paid on time)

- No requirement for credit card.

- Instant approval.

- Useful for emergencies.

- Small payments.

- Flexible repayments options.

- Helps to manage cash flow.

Benefits of BNPL(For Business/Retailer):

- More customers complete purchases.

- People buy more(Higher scales).

- Cart abandonment reduced.

- Merchant gets paid instantly.

This is the reason why many retailers promote BNPL heavily.

Limitations (cons) of BNPL:

1.Forget to pay:

Misses payments lead to penalties, instead account suspension and fines upto Rs 250-500.

2.credit-score impact:

Some BNPL lenders report to credit bureau/agency or department, late payments can hurt your credit score.

3.Overspending encouragement:

Take many BNPL, very easy to spend more than you can afford, and put you in debt trap.

4.Hidden Charges:

Processing fees, convenience fees, interest on longer EMIs.

5.Return Item?

If you return item, you still have to pay the BNPL.

6.Miss payments:

Miss 2 payments your CIBIL score will down.

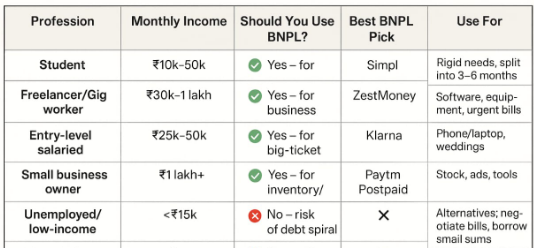

Who should Use BNPL?

Is BNPL Good or Bad?

Good if:

- Pay on time.

- Want cash flow flexibility.

- Don’t want credit card.

- Need short-term credit.

Bad if:

- Payments-miss regularly.

- Uncontrollable shopping.

- Use multiple BNPL accounts.

In conclusion,

In the end, BNPL is neither a hero nor a villain it’s simply a tool. For many people, it offers genuine help, the space to buy essentials without draining the month’s budget, this helps to handle small emergencies and easy to handle without having financial burden. But like any option it works for you only when use with discipline and wisely. #BNPL #buynowpaylater #fintech #loan #credit

Related Posts:

1)HDFC bank Millenia Credit card:HDFC Bank Millennia Credit Card Review 2025: Benefits, Cashback, Fees & Smart Usage Tips – Merchant Blogger

2)HDFC bank Freedom Credit card:The Ultimate Guide to HDFC Bank Freedom Credit Card-Entry level, Beginner Freindly-2025 – Merchant Blogger